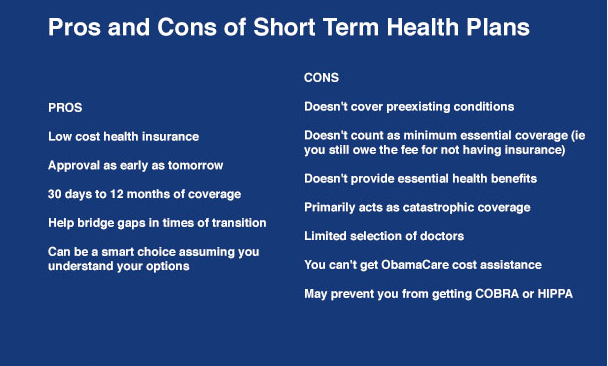

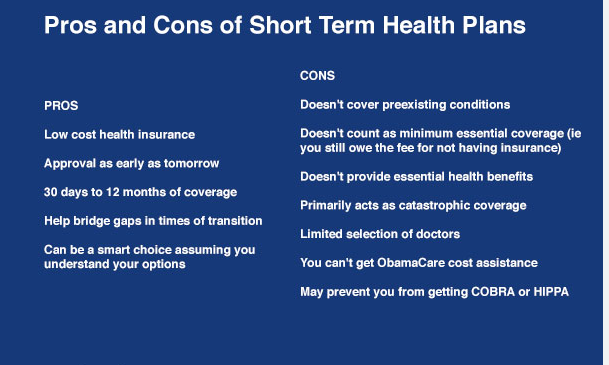

Short-Term Health Insurance: Pros and Cons

In today’s ever-changing world, health insurance is an essential safeguard for maintaining well-being and protecting against high medical costs. However, there are times when traditional health insurance plans, such as those offered through an employer or purchased on the Health Insurance Marketplace, may not be the right fit. For instance, if you’re between jobs, waiting … Read more