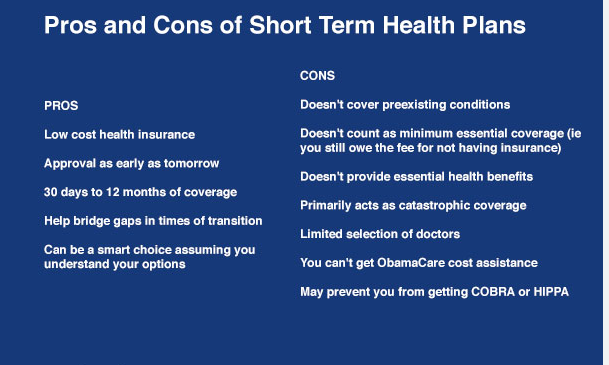

Short-Term Health Insurance: Pros and Cons

Health insurance is a vital part of ensuring that individuals and families are protected from high medical costs in case of illness or injury. However, for many people, obtaining long-term health insurance coverage may not always be practical or affordable. This is where short-term health insurance comes into play. Short-term health insurance is designed to … Read more